XRP Price Prediction: $5 Short-Term Target as Bulls Take Control

#XRP

- Technical Strength: MACD crossover and Bollinger Band squeeze suggest imminent volatility.

- Whale Activity: 900M XRP accumulation hints at institutional confidence.

- Regulatory Clarity: Ripple-SEC resolution removes a key overhang.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

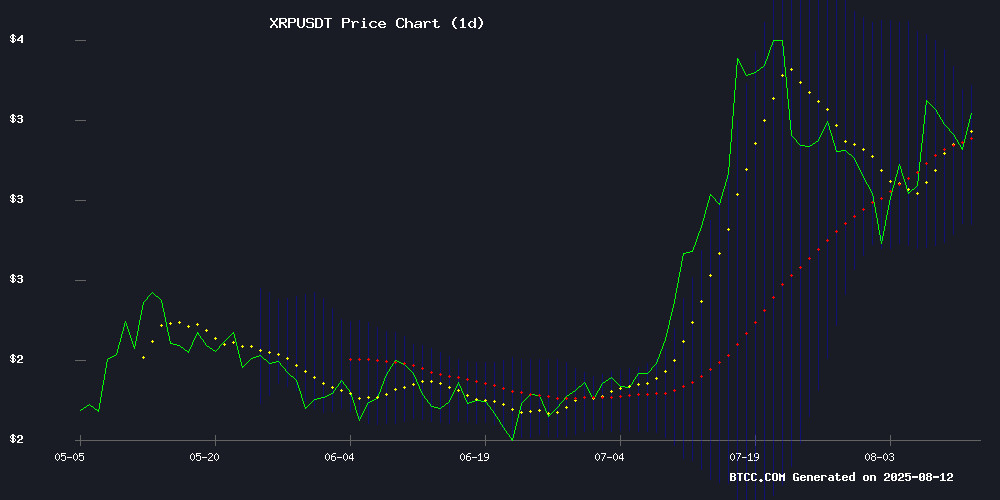

XRP is currently trading at 3.2279 USDT, above its 20-day moving average (3.1071), indicating a bullish trend. The MACD shows a positive crossover (0.0996 > 0.0944), reinforcing upward momentum. Bollinger Bands suggest volatility, with the price NEAR the upper band (3.3681), signaling potential overbought conditions. Analyst Emma from BTCC notes that if XRP holds above 3.10 USDT, a rally toward 3.50 USDT is likely.

XRP Market Sentiment: Whales and Regulatory Clarity Fuel Optimism

Recent news highlights bullish catalysts for XRP, including whale accumulation (900M tokens bought) and the resolution of the Ripple-SEC case. Analyst Emma from BTCC points to remittance adoption (Remittix nearing $20M funding) and ETF rumors as additional tailwinds. Short squeeze risks and technical breakouts could propel XRP toward $5 in the near term.

Factors Influencing XRP’s Price

XRP Price Eyes $5 As Whale Activity and Short Squeeze Risks Converge

XRP's recent price action has been marked by volatility, oscillating between $3.00 and $3.40 amid sharp rallies and pullbacks. Despite a 3.7% dip in the last 24 hours, the asset has surged 450% over the past year. On-chain data reveals whales accumulating 900 million XRP in 48 hours—a bullish signal often preceding major price movements.

Short positions dominate the market, outnumbering longs by 75%. A breakout above $3.40 could trigger a short squeeze, with $3.65 acting as a critical resistance level. Clearing this barrier may pave the way for a rally toward $5, potentially setting a new all-time high.

Exchange reserves remain thin, amplifying the impact of whale purchases. The combination of institutional accumulation and leveraged trader positioning suggests an explosive upside scenario is brewing.

XRP Price Consolidation Signals Potential Rally to $4 as Remittix Nears $20M Funding Milestone

XRP's price action suggests a period of consolidation may precede a significant upward move, with technical indicators echoing patterns from its 2017 bull run. Analysts project targets between $3.70 and $10, while whale accumulation of 900 million tokens in 48 hours adds fuel to bullish sentiment.

Parallel developments see Remittix approaching a $20M fundraising threshold, positioning itself as a potential disruptor in the remittance space. The project's impending exchange listing could catalyze further growth, drawing comparisons to established performers in the sector.

Market observers note striking similarities between current XRP price structures and historical breakout formations. Fractal analysis points to 2025 trading ranges of $1.81-$4.10, with the $4 level emerging as a key psychological benchmark.

Crypto.com Teams Up With VivoPower to Boost Digital Asset Management

Crypto.com and VivoPower have forged a strategic partnership to enhance digital asset management. The collaboration will see Crypto.com providing custodial services for VivoPower's growing digital asset treasury and mining operations.

VivoPower's shares will become tradable on Crypto.com's platform, exposing the company to over 150 million users. The deal also promises improved liquidity for XRP and other digital assets, alongside access to XRP restaking through Flare.

This alliance reinforces VivoPower's XRP-centric digital asset strategy while expanding its growth opportunities in the cryptocurrency space.

XRP Price Poised for Breakout as Bullish Technical Patterns Emerge

Ripple's XRP has retreated 13% from its year-to-date peak, yet the cryptocurrency shows signs of gathering momentum for its next upward move. A cup-and-handle formation on daily charts suggests accumulating pressure for a potential breakout toward $5, with the pattern's completion point at $3.40.

Technical indicators reinforce the bullish case. The asset maintains position above key moving averages while forming an inverse head-and-shoulders pattern within the handle phase. Murrey Math Lines analysis identifies strong support at current levels, with only a drop below $2.73 invalidating the positive outlook.

Network fundamentals appear equally promising. On-chain data reveals accelerating growth across the XRP Ledger ecosystem, providing fundamental support for the technical thesis. Market participants now watch the $3.65 level - a decisive breach could trigger the anticipated rally toward psychological resistance at $5.

Ripple-SEC Case Dismissal Debate Sparks Community Divide

The legal battle between Ripple Labs and the U.S. SEC has reignited debate after reports of a joint dismissal filing. Social media erupted with claims the case was over, but legal experts caution against premature celebration.

Procedural nuances under FRAP 42(b) allow appeals to close without judicial approval when both parties agree—a technicality some misinterpreted as total victory. Ripple's existing penalties and the court's prior ruling remain unaffected.

XRP holders initially cheered what appeared to be a turning point, while analysts emphasized the distinction between procedural closure and substantive resolution. The crypto community remains divided on the implications.

SEC Shifts Focus to Crypto Regulation After Ripple Case Resolution

The Securities and Exchange Commission is turning the page on its protracted legal battle with Ripple Labs, signaling a potential pivot toward clearer regulatory frameworks for digital assets. The case's conclusion—marked by mutual agreement to drop appeals—has freed the agency to prioritize policy development over litigation.

SEC Chair Paul Atkins framed the settlement as a watershed moment. "We're shifting energy from the courtroom to the policy drafting table," he stated, echoing Commissioner Hester Peirce's call for regulatory clarity. The five-year dispute centered on whether Ripple's $1.3 billion XRP sales constituted unregistered securities offerings.

A 2023 court ruling created partial resolution, distinguishing between institutional sales (deemed securities) and retail transactions (exempted). Ripple's subsequent $125 million penalty in 2024 paved the way for this final settlement. Market observers view the outcome as validation for XRP's hybrid status—neither fully security nor commodity.

SEC Chair Paul Atkins Calls XRP Lawsuit a Turning Point

The resolution of the Ripple vs. SEC lawsuit has marked a pivotal moment for the crypto industry, with SEC Chair Paul Atkins heralding it as a regulatory turning point. The August 7 ruling not only ends years of uncertainty for XRP holders but also signals a shift toward more constructive U.S. digital asset oversight.

Atkins, a vocal pro-crypto advocate, emphasized moving the SEC's focus from litigation to policy-making, aligning with Commissioner Hester Peirce's stance. This departure from former Chair Gary Gensler's enforcement-heavy approach aims to foster innovation while ensuring investor protection.

Ripple's Chief Legal Officer, Stuart Alderoty, acknowledged Atkins' role in advancing clearer crypto regulations. Meanwhile, Atkins unveiled "Project Crypto," a initiative to draft a transparent regulatory framework for digital assets, reflecting broader U.S. efforts to integrate cryptocurrencies into the financial system.

XRP Whales Scoop Up 900 Million Tokens: Is a Bullish Surge Imminent?

XRP whales have aggressively accumulated 900 million tokens within 48 hours, signaling strong confidence as the price stabilizes at $3.14. This substantial buying activity, tracked by on-chain analyst Ali Martinez, suggests institutional conviction during a consolidation phase.

Technical analysis indicates a critical juncture for XRP. Holding support at $3.20–$3.25 could propel the token toward $4.50, while a breakout above $2.70 resistance has already set the stage for bullish momentum. The $3.00 level now serves as key support for further gains.

Market observers note XRP is retesting the upper boundary of a bull flag pattern. A sustained break above $3.33 resistance could trigger moves toward $3.50, with $3.15 acting as crucial support to confirm bullish continuation.

Unilabs vs XRP ETF Rumors: Can AI Asset Manager Lead 2025 Rally

Ripple's XRP token charts a bullish trajectory, breaching the $3.22 resistance level amid heightened institutional interest. The resolution of the SEC lawsuit and emerging XRP ETF speculation have ignited a 208% surge in trading volume, propelling prices toward the $3.40-$3.60 resistance band.

Unilabs enters the spotlight with a $12.5 million presale raise, positioning its UNIL token as potential competition to XRP's market dominance. The project's rapid presale sellouts suggest growing investor appetite for AI-driven asset management solutions.

Technical indicators reveal critical thresholds: sustained momentum above $3.3075 could trigger a rally toward $3.4650, while $2.80 establishes firm support. Market participants now weigh ETF prospects against Unilabs' disruptive potential in the altcoin arena.

XRP Price Prediction: Analyst Eyes $12.60 Target After SEC Lawsuit Resolution

XRP, the third-largest cryptocurrency by market capitalization, is showing signs of a potential breakout as it consolidates near $3.13. Crypto analyst Ali Chart identifies a multi-year triangle pattern breakout in November 2024 as the foundation for a bullish target of $12.60—a nearly 300% increase from current levels.

The technical outlook coincides with Ripple's legal victory over the U.S. SEC. On August 8, 2025, regulators dropped their appeals in the long-running lawsuit, though Ripple faces a $125 million fine. This resolution removes a key overhang that had weighed on XRP's valuation since 2020.

Market participants are watching the $3.00-$3.20 support zone closely. A weekly close above this range could validate the bullish thesis, while failure to hold may delay the projected rally. The $12.60 target derives from measuring the triangle's base and projecting it upward from the breakout point—a classical technical analysis approach.

XRP Tests Key Support at $3.08 Amid Market Correction

XRP's bullish momentum faltered as it retreated from a brief surge above $3.30, now hovering near critical support levels. The digital asset failed to sustain its breakout above the $3.25 resistance zone, slipping below the 100-hour moving average and testing the $3.08 Fibonacci support level.

Earlier gains saw XRP reach $3.38 before encountering selling pressure. The breakdown below the $3.20 triangle pattern support intensified bearish sentiment. Market participants are watching the $3.08 level closely—a hold here could stabilize prices for another upward attempt, while failure may trigger further declines.

Key resistance levels now stand at $3.22, $3.26, and $3.35. A decisive break above these thresholds could reignite bullish momentum toward $3.45. The current pullback reflects broader market caution as traders reassess risk appetite in the crypto sector.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, BTCC's Emma provides the following projections:

| Year | Price Target (USDT) | Catalysts |

|---|---|---|

| 2025 | 5.00 - 12.60 | ETF approval, remittance growth |

| 2030 | 18.00 - 30.00 | Mainstream adoption, interoperability |

| 2035 | 50.00+ | CBDC integration, global liquidity |

| 2040 | 100.00+ | Store of value status, AI-driven demand |

Predictions assume favorable regulatory and macroeconomic conditions.